Two giants in inflight communications, Viasat and Inmarsat, are joining forces. The two companies have reached a definitive agreement whereby Viasat will acquire Inmarsat in a transaction valued at US$7.3 billion, comprised of US$850.0 million in cash, approximately 46.36 million shares of Viasat common stock valued at US$3.1 billion (based on the closing price on 5 November, 2021), and the assumption of US$3.4 billion of net debt. The transaction is expected to close in the second half of calendar year 2022, subject to approvals.

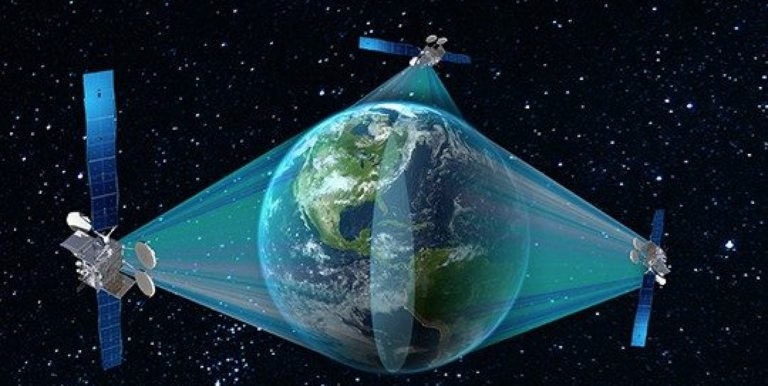

The combined company intends to integrate the spectrum, satellite and terrestrial assets of both companies into a global high-capacity hybrid space and terrestrial network. This advanced architecture will create a framework incorporating the most favourable characteristics of multi-band, multi-orbit satellites and terrestrial air-to-ground (ATG) systems that can deliver higher speeds, more bandwidth, and greater density of bandwidth at high-demand locations such as airports and shipping hubs. The joint entity also intends to offer lower latency at lower cost than either company could provide alone.

According to Viasat and Inmarsat the combined company will be able to offer:

• A broad portfolio of spectrum licences across the Ka-, L- and S-bands and a fleet of 19 satellites in service, with an additional 10 spacecraft under construction and planned for launch within the next three years.

• A global Ka-band footprint, including planned polar coverage, to support bandwidth-intensive applications, augmented by L-band assets that support all-weather resilience and highly reliable, narrowband and IoT connectivity.

• The ability to unlock greater value from Inmarsat’s L-band spectrum and existing space assets by incorporating Viasat’s beamforming, end-user terminal and payload technologies and its hybrid multi-orbit space-terrestrial networking capabilities.

Viasat’s vertically integrated technology and service offerings, along with Inmarsat’s eco-system of technology, manufacturing and service distribution.

“This is a transformative combination that advances our common ambitions to connect the world. The unique fusion of teams, technologies and resources provides the ingredients and scale needed for profitable growth through the creation and delivery of innovative broadband and IoT services in new and existing fast-growing segments and geographies,” said Viasat’s executive chairman, Mark Dankberg. “Together, we can advance broadband communications and create new hybrid space and terrestrial networks that drive greater performance, coverage, speed, reliability and value for customers.”

“Joining with Viasat is the right combination for Inmarsat at the right time,” added Rajeev Suri, CEO of Inmarsat. “Viasat is a terrific innovator and Inmarsat brings some powerful additions: global reach, a broad distribution channel, robust business momentum and a presence in highly attractive global mobility segments. Together, the two companies will create a new global player with the scale and scope to help shape the future of a dynamic and growing industry. The combination will create a strong future for Inmarsat and be well-positioned to offer greater choice for customers around the world, enhanced scope for partners, and new opportunities for employees. The industrial logic is compelling and ensures that the UK has a strong and sustainable presence in the critical space sector for the long term.”

Rick Baldridge, Viasat’s president and CEO added, “This strategic move gives Viasat the scale to increase the pace of innovation that drives new and better services for our customers, broadens the opportunities for our employees and provides a foundation for significant positive free cash flow, with potential upside from a revitalisation of L-band and IoT service growth. Plus, we will have expanded scale and presence in the US$1.6 trillion broadband and IoT sectors. I’m excited about the opportunities ahead.”

At the closing of the transaction, Viasat intends to expand its board of directors, from eight members to 10, with Andrew Sukawaty, current chairman of Inmarsat, being appointed as one of the two new board members. A second new board member will be appointed at transaction closing by the current Inmarsat shareholders. Decisions regarding management of the combined company following the closing of the transaction will be made as part of the integration planning process.