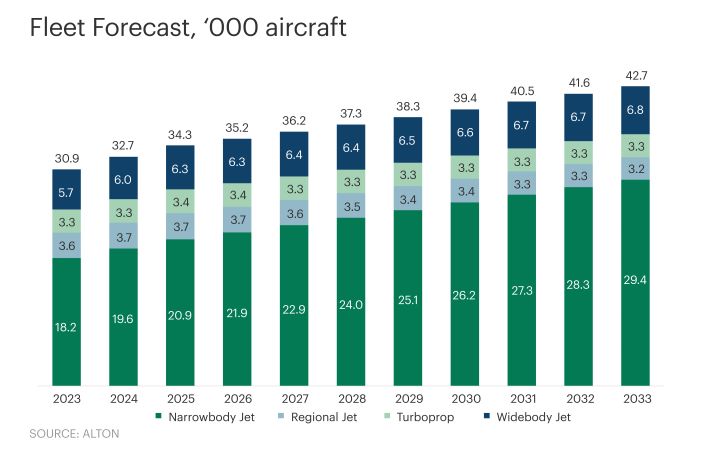

A report has been released which forecasts that the worldwide commercial aircraft fleet will grow 3.3% annually from 29,000 to 42,000 over the next 10 years, notwithstanding the ongoing geopolitical and supply chain challenges impacting the production rates of Original Equipment Manufacturers (OEMs).

The forecast is by Alton Aviation Consultancy, a global aviation advisory firm, which has been analysing the industry’s recovery, and created a 10-year forecast of air traffic and the active fleet. The independent 2023-2033 Commercial Aircraft and Engine Fleet Forecast finds that an uneven aviation recovery will cause OEMs to largely focus on tackling near-term supply chain issues and continuing research and development, but not launch major new programmes in the near term. With market pressure for the sector to make more progress in achieving its sustainability goals, OEMs will continue technology development and advancement for launching new aircraft programmes in the mid-term.

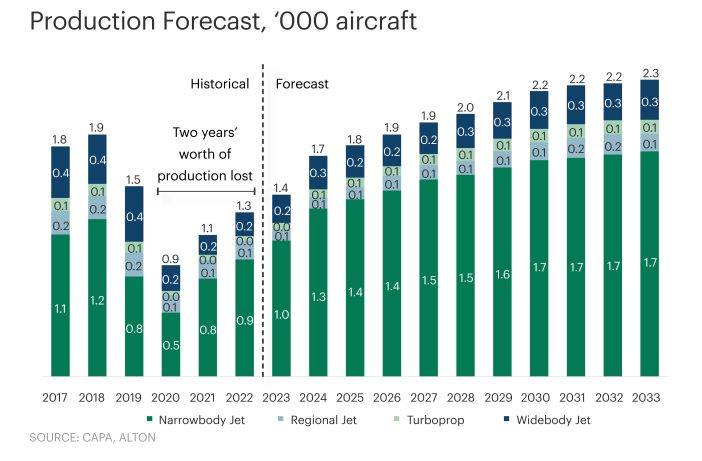

“While the aviation recovery is well underway, it remains unbalanced in several ways,” said Adam Guthorn, report co-author and managing director at Alton’s New York office. “While we forecast air traffic to return to pre-pandemic levels in 2024, this recovery will vary by region, with Asia Pacific not returning to 2019 levels until early 2025. This is underpinned by leisure travel recovering more quickly than business travel coming out of the Covid pandemic, but with no long-term structural changes in business travel demand. OEMs impacted by skilled labour shortages, parts shortages and manufacturing delays have struggled to ramp-up production at a quick enough rate to meet short-term demand for new aircraft.”

Joshua Ng, report co-author and director in Alton’s Singapore office, added: “While sustainability has become an increasingly important focus following the pandemic, no new clean-sheet aircraft family designs aside from the Boeing 777X and potential Airbus A220-500 derivative are expected to enter into service prior to 2030. Instead, with significant aircraft order backlogs for in-production aircraft types, the immediate focus for airframe OEMs like Airbus and Boeing will be operational improvements aimed at increasing production rates to meet current demand, alongside some additional family derivatives.

“Additionally, while clean-sheet aircraft with new technology engines may offer a 10-15% reduction in carbon emissions, this alone would still fall far short of current sustainability ambitions, which has shifted the conversation toward sustainable aviation fuel (SAF) that can be incorporated into existing aircraft in the near term. Electric and hydrogen propulsion systems will start to have an impact at the lower seat-count aircraft types by 2030, and will eventually be incorporated on larger aircraft as technology matures, likely in the mid-to-late 2030s and beyond.”

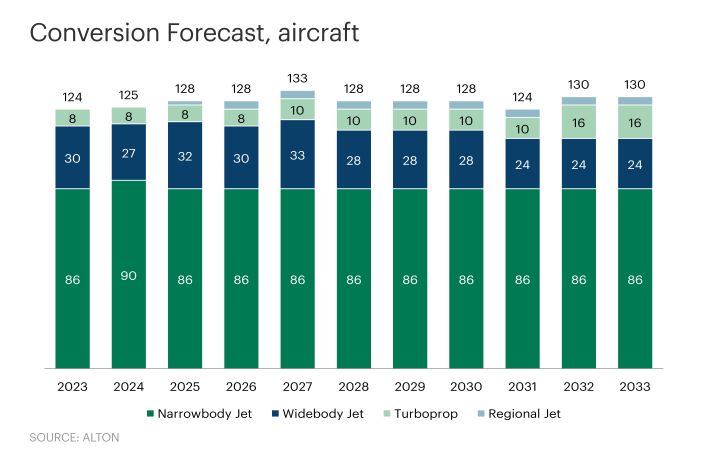

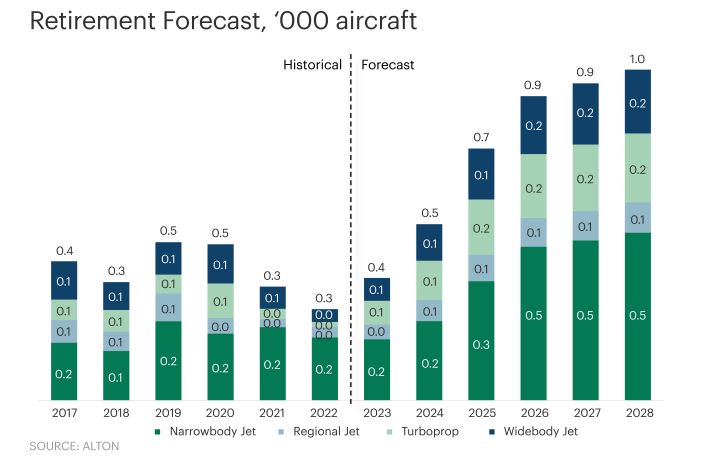

Alton’s report also charts how supply-chain challenges have resulted in aircraft retirements decreasing below the historical average while demand for leasing aircraft, particularly narrowbody jets, has surged, and finds that cargo conversion momentum will continue to be sustained by fleet replacement dynamics due to the age of the current fleet.