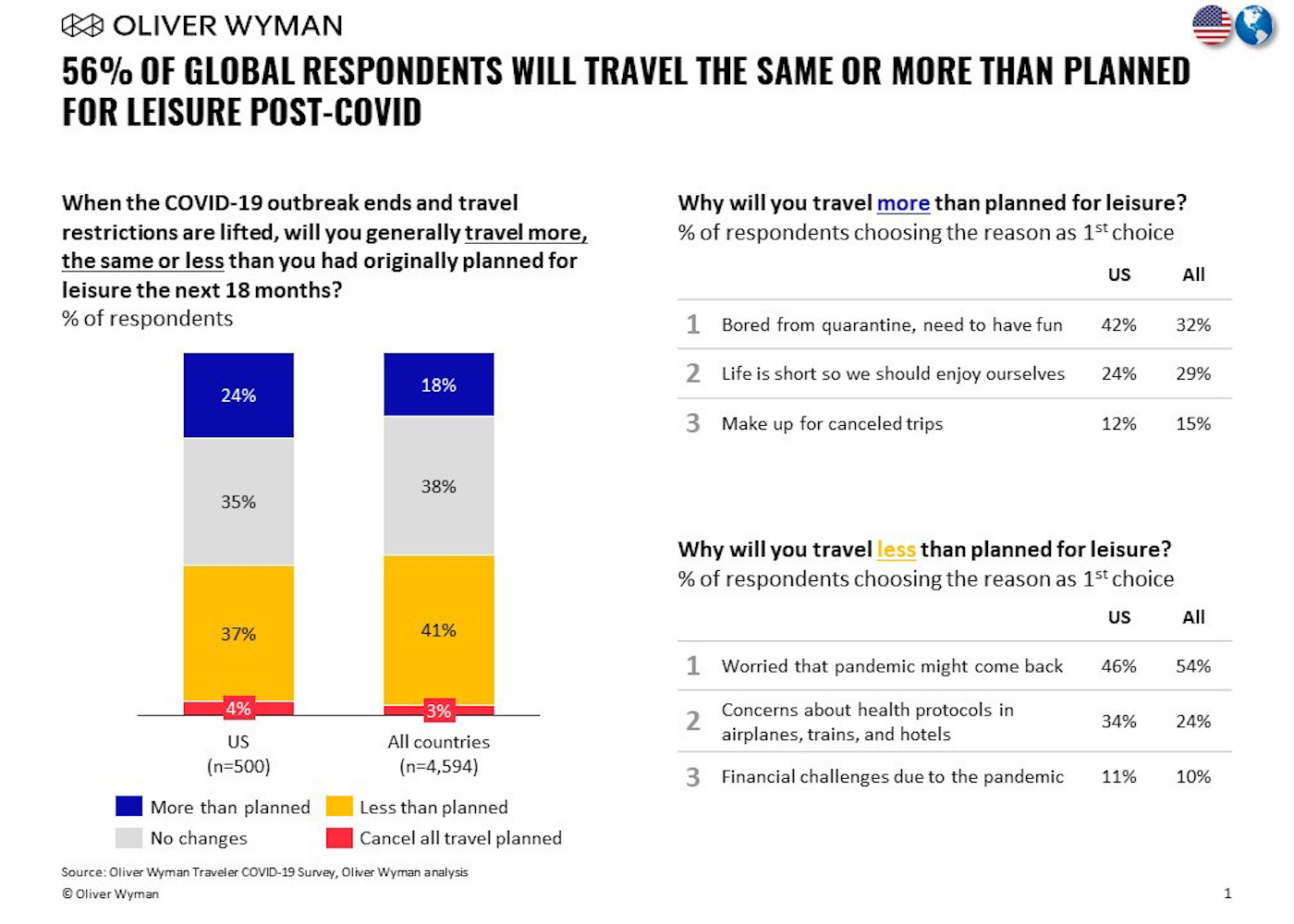

According to a survey conducted by management consultancy, Oliver Wyman, 60% of Americans are looking forward to travelling again. And Americans aren’t alone, as globally 56% of the 4,600 travellers surveyed indicated that they plan to travel the same or more once Covid-19 travel restrictions ease – and most want to travel by air.

Half of the US-based survey respondents said that they are just waiting for their government or the World Health Organization (WHO) to indicate when it is safe to travel before taking to the skies. Only 20% said that they are holding out for acquired immunity or a vaccine before they resume travel.

“Though the timing of the return to travel is dependent on when government authorities deem it safe, the desire to travel is strong and comfort levels are surprisingly high,” said Jessica Stansbury, a partner with Oliver Wyman. “This pent-up demand for leisure travel will spark the initial recovery of the industry.”

These findings also hold true globally, in the survey findings. Data from across Europe, China, Australia and Canada confirm cautious optimism in the travel industry. The consultancy found that travellers are tired of quarantine and are eager to make up for lost vacations, though most will now stay closer to home and away from crowded activities.

Comfortable returning to the skies

The survey found that globally travellers are significantly more comfortable flying than with any other mode of transport apart from driving. US travellers are more comfortable flying (51%) than doing any of the following: staying in a hotel (48%), dining in restaurants (46%), using rideshares (25%) or going on public transportation (23%).

Travellers in the US and Australia fall just behind China in being the most comfortable to take a flight. Italians are the least comfortable flying and are also the least comfortable overall using any other mode of transportation post-Covid. In the US, travellers aged between 30-44 are more comfortable taking a flight than younger people (18-29) and older people (45+).

Respondents said that the airlines’ response to Covid-19 was the most important reason, after price, for choosing to fly in the future. Indeed almost 70% said that the airline response so far has been positive. This is especially true among elite travellers, with almost 80% feeling that their primary airlines’ response to Covid-19 was favourable.

In terms of hotels, globally, 64% said that improvements in health and the cleaning of rooms and public spaces will significantly impact their decision to stay at a hotel. Almost 70% of travellers globally trust their primary hotel brand’s enhanced cleaning policies, found the survey.

“There is no longer a middle ground when it comes to cleanliness, and this – combined with the customer experience – will be a key differentiator,” said Bruce Spear, a partner with Oliver Wyman. “Trusted brands define and can ensure a consistent standard, giving them an advantage moving forward. We expect the expansion of the sharing economy to slow as travellers favour brand-name hotels or staying with friends and family as opposed to independents and private rentals.”

The survey found that 80% of global travellers prefer to stay at a large hotel, compared to 57% for home rentals. For US travellers, 83% would like to stay at a large hotel and 61% in home rentals. In China, 94% prefer large hotels, with 49% looking at home rentals.

Local destinations preferred

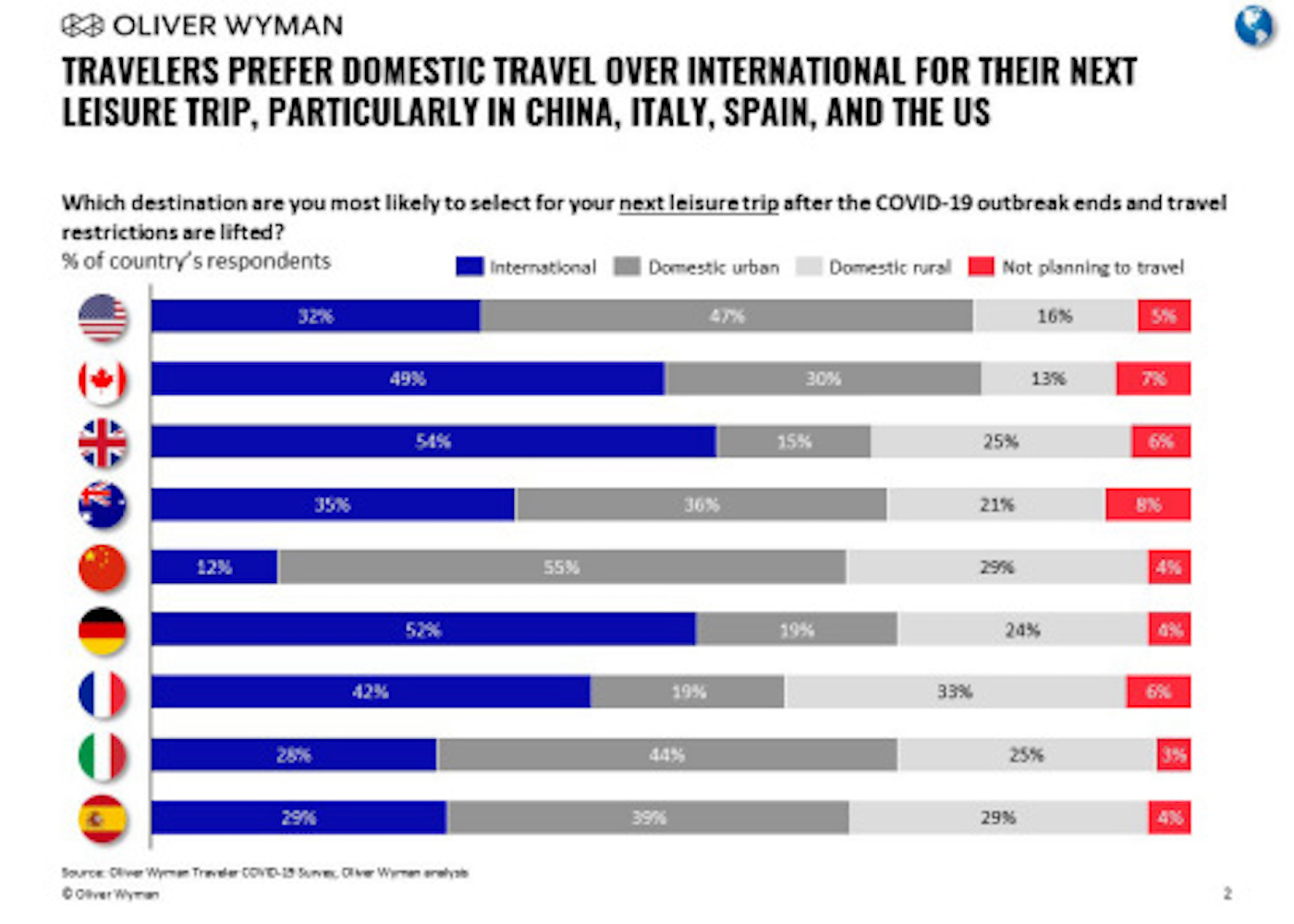

People in China, Italy, Spain,and the US are the most likely to travel domestically for their next leisure trip, according to findings. In the US, this means travel closer to home such as other US states, Canada, and the Caribbean instead of Europe, Asia or Africa.

Oliver Wyman also examined business travel trends and found a strong desire to return to business travel. Approximately 75% of Americans who travel by air for business intend to travel the same or more when restrictions are lifted. However, this doesn’t consider possible changes in corporate travel policies.

“While there will not be an immediate recovery and traveller preferences and expectations have likely shifted for good, we see a light at the end of the tunnel for the industry,” concluded Stansbury.