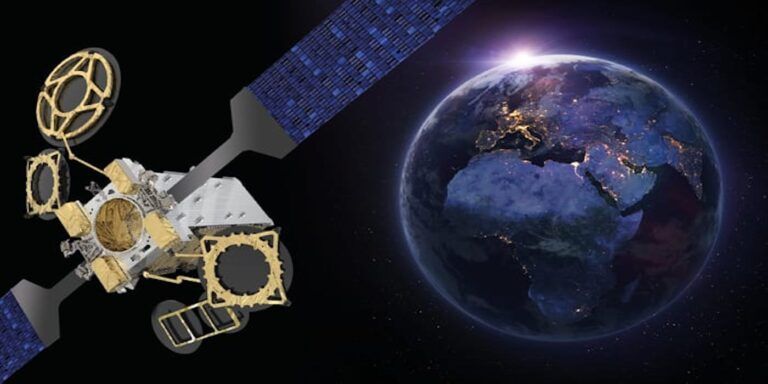

The shareholders of Eutelsat Communications and OneWeb have signed a Memorandum of Understanding with the objective of creating a leading global player in connectivity through the combination of both companies. The all-share transaction, expected to close by the end of Q2 2023, will see Eutelsat combine its fleet of 36 geostationary (GEO) satellites with OneWeb’s constellation of 648 Low Earth Orbit (LEO) satellites, of which 428 are currently in orbit.

The commercial partnership builds on the collaboration between Eutelsat and OneWeb, which began in April 2021 when Eutelsat acquired an equity stake in OneWeb, and was followed by a global distribution agreement between the companies announced in March 2022.

OneWeb will continue to operate the LEO business, trading under the same name, and at its existing UK headquarters. Eutelsat will continue to be headquartered and domiciled in France, listed on Euronext Paris, and subject to meeting eligibility requirements and gaining the approval of the UK Financial Conduct Authority, would apply to trade on the London Stock Exchange.

The transaction would be structured as an exchange of OneWeb shares by its shareholders (other than Eutelsat), with new shares issued by Eutelsat, such that, at closing, Eutelsat would own 100% of OneWeb (excluding the ‘Special Share’ owned by the UK Government). OneWeb shareholders would receive 230 million newly issued Eutelsat shares, representing 50% of the enlarged share capital.

Eutelsat and OneWeb will work to benefit from the growing connectivity market, with the B2B segment forecast to grow by three times and B2C by five times over the next decade, to reach a combined value of circa US$16bn by 2030, with growth being served by both GEO HTS and LEO capacity. The companies believe the combination of GEO’s network density, attractive economics and high throughput with the low latency and ubiquity of LEO, will create an optimal solution to address a wider range of customer needs.

Transaction opportunities

Once the deal is finalised, a roadmap is in place to develop a complementary GEO/LEO service between Eutelsat and OneWeb , which will create a ‘one-stop shop’ for customers, including a common platform, hybrid terminals and a fully mutualised network.

Sunil Bharti Mittal, OneWeb’s executive chairman said “The positive early results of our service together with our strong pipeline represent a very exciting opportunity in the fast-growing satellite connectivity segment, especially for customers requiring a high speed, low-latency experience. Our customers are actively seeking a combined GEO/LEO offering leading us towards this important step.”

The companies project further opportunities from the transaction, including combined revenues of circa €1.2bn and EBITDA of circa €0.7bn in FY22-23, with revenues forecast to grow at low double-digit CAGR over the next decade. EBITDA is expected to grow at a mid-teen CAGR over the medium to long term, outpacing sales growth, with EBITDA margin levels moving gradually back in line with best-in-class GEO standards.

“Bringing together our two businesses will deliver a global first, combining LEO constellations and GEO assets to seize the significant growth opportunity in connectivity, and deliver to our customers solutions to their needs across an even wider range of applications. This combination will accelerate the commercialisation of OneWeb’s fleet, while enhancing the attractiveness of Eutelsat’s growth profile,” said Dominique D’Hinnin, chairman of Eutelsat. “In addition, the combination carries significant value creation potential, anchored on a balanced mix of revenue, cost and capex synergies. The strong support of strategic shareholders of both parties is a testament to the huge opportunity that this combination offers and the value that will be created for all its stakeholders. This is truly a game changer for our industry.”

Service and revenue synergies

The combination of the two companies is forecast to generate average annual revenue synergies estimated at circa €150m after four years, with hybrid GEO/LEO offerings providing a premium service to customers as well as improving the fill rate. The synergies are expected to generate annual run-rate savings of over €80m pre-tax after five years, mostly through cost duplication avoidance. Capex optimisation is expected to generate average savings estimated at circa €80m per annum, from year one.

This would be achieved by leveraging the hybrid GEO/LEO satellite infrastructure and through the improved purchasing power of the combined entity. The capex of the combined entity is estimated in average at some €725m to €875m, per annum, over the period FY23-24 – FY29-30. According to the companies, these sources of incremental value creation represent a balanced split between revenues, costs and capex. Taken together they could equate to a net present value of over €1.5bn after tax (net of implementation costs).

Dominique D’Hinnin would be proposed as chairman of the combined entity and Sunil Bharti Mittal as co-chairman (vice-president). Eva Berneke would continue as CEO of the combined entity. Eva Berneke said “Our initial investment in OneWeb was underpinned by our strong belief that the future growth in connectivity will be driven by both GEO and LEO capacity. This belief has intensified as our relationship with OneWeb has deepened, first by raising our stake in the company, and then with the global distribution agreement signed a few months ago. We are now moving to the next level, with a full combination that will ensure the potential of the GEO/LEO integration is fully realised, supported by compelling financial, strategic, and industrial logic.

“This ground-breaking combination will create a powerful global player with the financial strength and technical expertise to accelerate both OneWeb’s commercial deployment, and Eutelsat’s pivot to connectivity. The combined entity will be geared towards profitable growth, with strong medium-term cash flow generation and a rapid deleveraging driven by strong forecast EBITDA growth. The benefits for our customers and strategic partners, who are at the centre of our strategy, are both significant and unique.”