2022 sees Qatar Airways Group celebrate its 25th year of operations, an occasion marked by something rather more meaningful than a party: its annual report for fiscal year 2021/22 shows a record net profit of US$1.54 billion (QAR 5.6bn), some 200% more than its previous highest annual profit. This is quite an achievement given the past two years have been the most difficult period ever in the global airline industry, due to pandemic travel restrictions.

The airline credits the positive results to its agile responses to changes in the market, and a successful strategy focused on customer needs and evolving market opportunities, as well as efficiency and employee commitment. The profit figure is not only a record for Qatar Airways Group, but, says the airline, also a record among all other airlines that have published financial results for this financial year.

The record net profit of US$1.54bn is joined by some other remarkable figures. During fiscal year 2021/22, the group’s overall revenue increased to US$14.4bn (QAR 52.3bn), up 78% compared to last year, and a remarkable 2% higher than the full financial year pre-Covid (2019/20). Passenger revenue increased by 210% over the last year, due to the growth of the Qatar Airways network, increase in market share and higher unit revenue, marking growth for the second financial year in a row. Qatar Airways carried 18.5 million passengers in the 2021/22 fiscal year, an increase of 218% over last year’s figure.

Another driver of profit was that Qatar Airways Cargo kept a leading position in the market, with revenue growth of 25% over last year with the growth in cargo capacity (available tonne kilometres) of 25% annually. The cargo division is safeguarding its operations with measures such as new fire-resistant cargo containers from Safran Cabin – a design that won a 2022 Crystal Cabin Award. Qatar Airways Cargo was a major operator during the pandemic, transporting more than 3 million tonnes of air freight and securing an 8% share in the global market. Cargo has transported more than 600 million doses of Covid-19 vaccines over the course of the pandemic to date.

The Group generated an EBITDA margin of 34%, at US$4.9bn (QAR 17.7bn). EBITDA (earnings before interest, taxes, depreciation, and amortisation, a measure of a company’s overall financial performance) was higher than the previous year by US$ 3.2bn (QAR 11.8bn). The Group says these record earnings are the result of decisions made during the pandemic to expand Qatar Airways’ passenger and cargo networks, creating an accurate forecast of global market recovery, building customer and trade loyalty and product excellence, and strong cost controls.

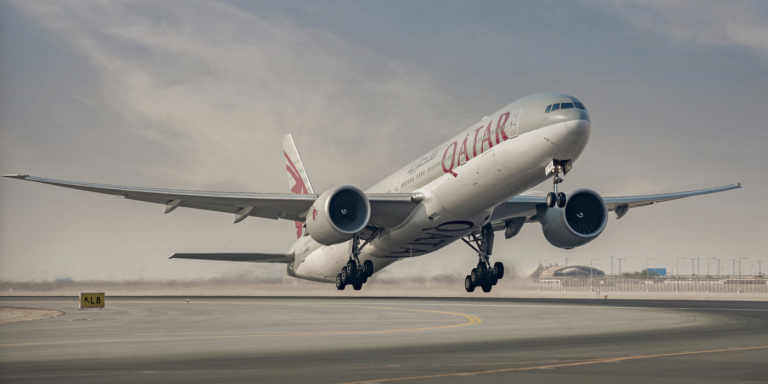

Even amid tricky Covid-19 market conditions, Qatar Airways grew its network to more than 140 destinations in 2021/22, opening new routes including Abidjan, Côte d’Ivoire; Lusaka, Zambia; Harare, Zimbabwe; Almaty, Kazakhstan; and Kano and Port Harcourt, Nigeria, in addition to resuming flights to key markets across Europe, Africa, the Middle East and Asia. The company has operated continuously the largest network among all Middle Eastern airlines, as measured by number or destinations as well as weekly flights.

“We have pursued every business opportunity and left no stone unturned as we aimed to meet our targets,” said Akbar Al Baker, Qatar Airways Group’s chief executive. “I am extremely proud of the decisions we have made to embrace efficiency and achieve strong cost control across several operational departments whilst engaging in environmental and sustainable initiatives. This has positioned us at the forefront in the field of sustainability, including environmental protection and social commitment. Our strategic investments in a varied fleet of modern, fuel-efficient aircraft has helped us overcome the significant challenges related to capacity constraints while balancing commercial needs as swiftly as possible.”