Indian low-cost airline, IndiGo, the largest airline in India in terms of passengers carried and fleet size, has placed a firm order for 500 A320 Family aircraft at Paris Air Show – an order that sets a new record for the biggest single purchase agreement in the history of commercial aviation. This latest agreement takes the total number of Airbus aircraft on order by IndiGo to 1,330, making it the world’s biggest customer of A320 Family aircraft.

The A320 Family has the widest cabin in the single-aisle sector, and an order book of more than 8,700 orders from over 130 customers. IndiGo has already partnered with Recaro to fit its BL3710 economy-class seats on its A320neo and A321neo aircraft.

The purchase agreement was signed in Paris by Rahul Bhatia, managing director of IndiGo, Dr Venkataramani Sumantran, chairman of IndiGo, Pieter Elbers, CEO of IndiGo, Guillaume Faury, CEO of Airbus, and Christian Scherer, chief commercial officer and head of international at Airbus.

New Delhi-headquartered IndiGo is among the fastest growing carriers in the world. Since its first A320neo aircraft was delivered in March 2016, its fleet of A320neo Family jets has grown into one of the world’s largest, with 264 aircraft in operation (162 A320neo, 79 A321neo, 21 A320ceo and 2 A321 freighters). IndiGo placed its first order with Airbus in 2005 (100 A320 Family) and again in 2011 (180 A320 Family including the NEO), in 2014 (250neo Family), and in 2019 (300 A320neo Family), taking its previous total order book to 830 A320 Family aircraft.

The India market

India has become one of the hottest markets for aircraft manufacturers as airlines such as IndiGo and Air India have been placing hundreds of new orders to support growth plans based on India’s vast untapped demand for air travel. The country will soon have the world’s largest population, yet it is also relatively underserved in terms of airline capacity, according to research by CAPA.

Lured by the potential of this untapped capacity, India’s airlines have collectively placed significantly more orders than the current fleet size. Comparing India with China is an interesting exercise, as they now have very similar population sizes, and are both fast-growing aviation markets. CAPA’s research makes for interesting reading.

IndiGo and Airbus views

Pieter Elbers, CEO of IndiGo, said of the order, “It is difficult to overstate the significance of IndiGo’s new historic order for 500 Airbus A320 Family aircraft. An order book now of almost 1,000 aircraft well into the next decade, enables IndiGo to fulfil its mission to continue to boost economic growth, social cohesion and mobility in India. At IndiGo, we take pride in being India’s preferred airline for connectivity in and with India; and by doing so, being one of the leading airlines in the world. This order strongly reaffirms IndiGo’s belief in the growth of India, in the A320 Family and in our strategic partnership with Airbus.”

Airbus’s Christian Scherer added, “This landmark order marks a new chapter in Airbus and IndiGo’s relationship that is democratising affordable air travel for millions of people in the world’s fastest-growing aviation market. It is also a resounding endorsement of the A320 Family’s best-in-class operating economics that have been powering IndiGo’s growth for almost two decades. We cherish our long-standing relationship with IndiGo and are proud of our success together. We look forward to contributing to the growth of India’s air connectivity in its domestic network and into international markets through the expansion of this formidable partnership.”

Industry commentary

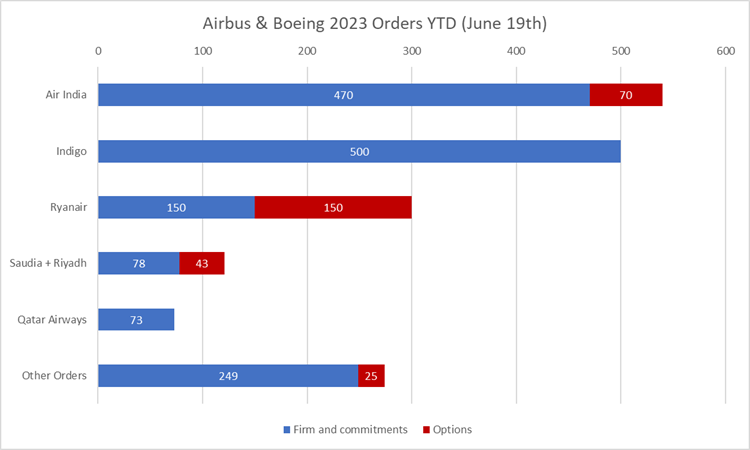

IBA, an aviation consultancy, notes that IndiGo’s order of 500 aircraft has “notably eclipsed” Air India’s order for 470 aircraft made in February this year (although there was also an option for 70 aircraft).

“When added to IndiGo’s substantial existing backlog, questions will arise whether the Indian market can accommodate this number of aircraft,” states IBA.

“Recent estimates have the market growing at 9% annually, with the Indian government also pledging $12bn to support infrastructure development. In addition to this, both IndiGo and Air India were running at operating losses until recently, with pricing making it difficult for new entrants to establish market share. So far in 2023, IndiGo has flown 57.5% of the country’s domestic market capacity. Air India and their future merger partners have only flown 26.6%.

“A final note is on the make-up of the order. Air India’s February order had marginally more Airbus aircraft (250 to 220 from Boeing). This order is entirely for Airbus.”