The outlook for aviation industry demand in 2023 is positive, but there may be increased consolidation, and failures of some weaker players. In particular, regional airlines may be at greater risk, and so it has turned out, with Flybe once again in administration.

It is worth remembering that Flybe was a struggling airline well before the pandemic, finding itself increasingly squeezed by low-cost airlines (and no thanks to a ridiculous double taxation on UK domestic flights, which has now been changed). In the run-up to the pandemic Flybe was trying, without success, to find a buyer.

The airline was eventually rescued in 2019 by a consortium including Virgin Atlantic, Stobart and Cyrus Capital. The timing was unfortunate, and Flybe was one of the first casualties of the Covid-19 pandemic, going into administration in March 2020 when lockdowns came into force in the UK and around the world.

The lowest cost wins

Cyrus Capital bought the business and assets, but in reality, the only real value was the 12 Heathrow slot pairs. Given that these slots were originally owned by British Airways but given up to Flybe as part of a remedy following the BMI takeover, the UK’s Civil Aviation Authority (CAA) would not allow Cyrus Capital to have the slots without being a viable operation.

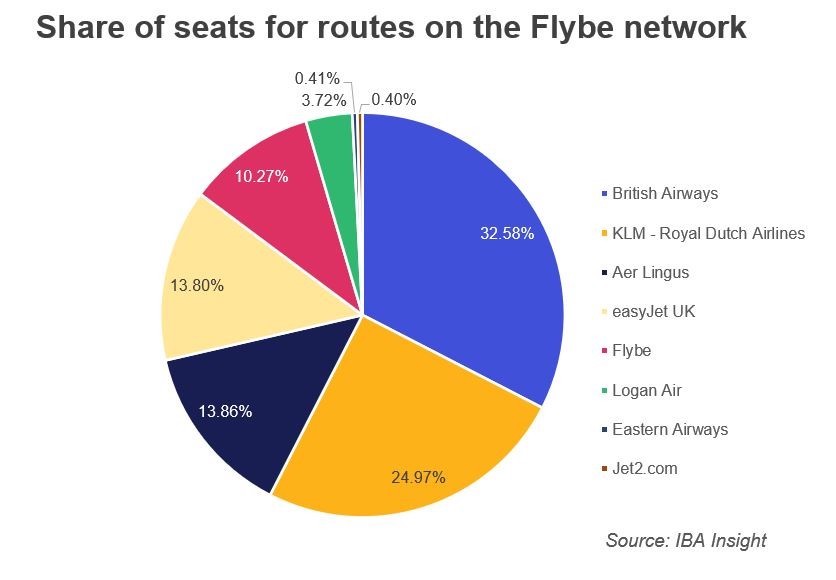

Cyrus found itself with no choice but to restart Flybe’s operations, but in an even worse strategic position than before the pandemic. IBA’s analysis shows that on the routes the airline operated, Flybe’s share of seats was only 10%, and it found itself competing with larger aircraft with a lower cost per seat. Lowest cost almost always wins on short-haul, and therefore it was inevitable that Flybe would struggle.

Will anyone buy Flybe?

In theory, Flybe’s slots will revert to British Airways now, and with its aircraft fleet leased, it is questionable whether there is any value that can be salvaged from the airline. Yes, in theory an investor could buy the business and try again, but is anyone crazy enough to try this? Well, this is the airline industry, so we wouldn’t totally rule it out. Though this is unlikely in our view, easyJet would love to take on British Airways at Heathrow, but 12 slot pairs are not enough to create a viable operation.

More consolidation is to come

In summary, IBA believes that in 2023, the divide between the strong and the weak will get even wider. We saw Ryanair report record Q3 profits, and other Tier 1 players are guiding very positively. So, we continue to believe there will be an acceleration in consolidation in 2023, which is very positive for pricing from the airline’s perspective – if not from the consumer’s.

About IBA

IBA provides deep aviation consultancy expertise, and actionable data insights. This independent business has over 35 years of heritage and experience in aviation.