One year on from Russia’s invasion of Ukraine, ForwardKeys’ analysis of the impact of the war on travel reveals a number of trends – some expected and others surprising. Predictably, sanctions and the ban on direct flights between Russia and most of the EU has dramatically reduced Russia’s air connectivity with the rest of the world.

However, the Middle East and Turkey, which have not banned flights to and from Russia, have benefited from a rise in air traffic to them and through them. In the year following the war, seat capacity between Russia and the Middle East was 27% greater than it was in the equivalent period before the pandemic, and Turkey 26%. By comparison, seat capacity was 99% less to the EU and UK, 92% less to North America, 87% less to Asia Pacific, 76% less to Africa and the rest of the Americas, and 20% less to the rest of Europe.

Perhaps the most surprising trend to emerge during the first 10 months of the war, was the wealthy Russians returning to international travel with a vengeance post-pandemic, whereas ordinary Russians stayed at home. From the start of the war on 24th February until the end of December, premium-class tickets for Russian outbound travel boomed, rising by 10% on pre-pandemic levels. By comparison, economy-class travel was down by 70%. However, from the start of 2023, the situation changed, with international travel collapsing in the first quarter of the year. As of 15th February, premium-class flight bookings for Q1 were 26% behind 2019 levels, and economy class 66% behind.

The destination which was most successful in attracting affluent Russians was Thailand, to where premium-class travel was up by 81% on 2019. It was followed by the UAE, up 108%, Turkey, up 41%, the Maldives, up 137%, and Egypt, up 181%.

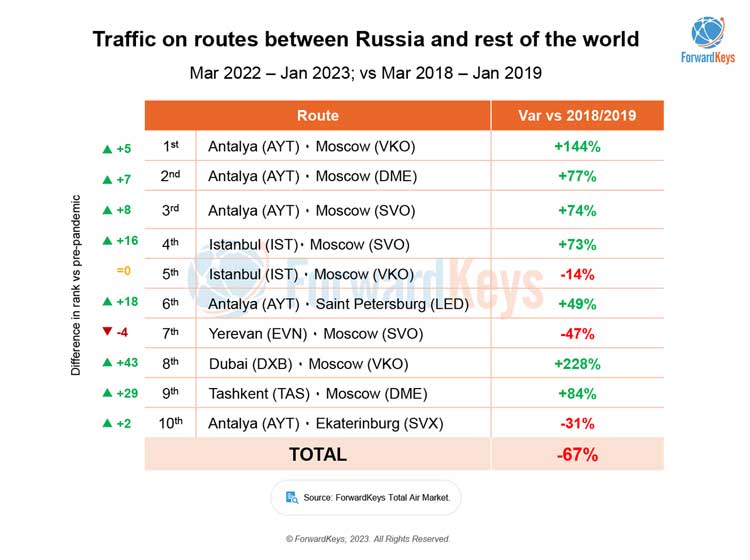

Looking at all travel, ie premium classes plus economy class bookings, the picture is different. The most popular route for Russians during the past year has been to and from Antalya, the Turkish riviera resort. Flights there from Moscow’s three major airports, Vnukovo, Domodedovo and Sheremetyevo, were up by 144%, 77% and 74%, respectively, compared to pre pandemic levels. The next busiest route was between Istanbul and Moscow Sheremetyevo, up 73%, and Vnukovo, down 14%. The sixth-busiest route was between St Petersburg and Antalya, up 49%. It was followed by Yerevan to Moscow Sheremetyevo (down 47%), Dubai to Moscow Sheremetyevo (up 228%), Tashkent to Moscow Domodedovo (up 84%), and Antalya to Ekaterinburg (down 31%).

One further notable impact of the war in Ukraine, and the closure of Russian air space to many airlines, has been the increase in costs and flight times between Europe and Asia Pacific. Those costs have been passed on in the form of higher air fares, which have also been influenced by the late reopening of Asian destinations. In the year following the start of the war, average air fares between Europe and Asia Pacific were 20% higher than before the pandemic in 2019, and 53% higher than in 2022.

On flight times, 37% of air traffic between the two continents now takes more than eight hours, up from 23% before the invasion. Routes that have been worst affected include those between Japan and South Korea in Asia Pacific going to/from France, Germany, Scandinavia and the UK in Europe.

The greatest impact on air travel to and from Russia since the invasion of Ukraine last February has been war-related sanctions, which have particularly benefitted Turkey and the Middle East, as they have maintained direct flights to and from Russia. We expect Chinese airlines will be another winner as they are still flying through Russian air space; and that gives them a competitive advantage in flight times and fuel costs on routes between Europe and Asia Pacific. However, the most eye-opening feature is the premium-class boom, which appears to illustrate a division in Russian society between the rich, who holidayed in style, while the less affluent stayed at home.”

About ForwardKeys

Founded in 2010, ForwardKeys has pioneered the way forward for tourism organisations, hotels, and retailers keen to understand who is travelling where, when, and for how long. The company has comprehensive ticketing data covering the globe, from online bookings to travel agencies and airlines, ticketing data to seat capacity and total air market (TAM).