Emirates Airline is retiring its fleet of A380 passenger jets, for which the Dubai-based carrier was Airbus’s biggest customer. Gloomy as the news is for investors in closed-end A380 funds, they can still expect to make a return on their investment.

Recent developments, with Emirates following the lead of Air France and Singapore Airlines in pulling A380s out of service, have not fundamentally changed the prospects for investors in the A380 funds. While we continue to believe that investors will not suffer any losses – see Scope’s report Airbus A380 – Part-Out as Final Option – investors cannot expect the high single-digit percentage returns originally projected in the prospectus, but will have to make do with returns in the lower single-digit range.

Interestingly, the prices of funds in which A380s are already in a part-out have risen slightly from previous lows, as the process has provided investors with greater certainty in the context of the expiry of the aircraft leases and return of the aircraft to their owners amid near-zero secondary-market demand for the planes.

Emirates is Airbus’s biggest customer for the A380

Emirates currently operates 112 A380-800s – nearly half of the world’s fleet. According to Emirates president Sir Tim Clark, the airline will gradually retire its A380-800s.The first two aircraft have already been taken out of service and will be subject to a part-out process.

The two specific aircraft models were retired because Emirates is planning a comprehensive overhaul of its existing fleet. It can make more economic sense to take older models out of service. Spare parts such as the landing gear can be reused for other existing aircraft. (This procedure is usually cheaper than buying a new main landing gear for e.g. US$25 million).

Background

German investors have invested around EUR 1.6 billion in a total of 21 Airbus A380s through closed-end funds. The lessees of these aircraft are Singapore Airlines, Air France and Emirates. In early 2019, Emirates announced that it would reduce its A380 order from a total of 162 units, to 123. As a result, Airbus announced that production of the A380 would cease in 2021.

Secondary market: Prices not yet bottoming out

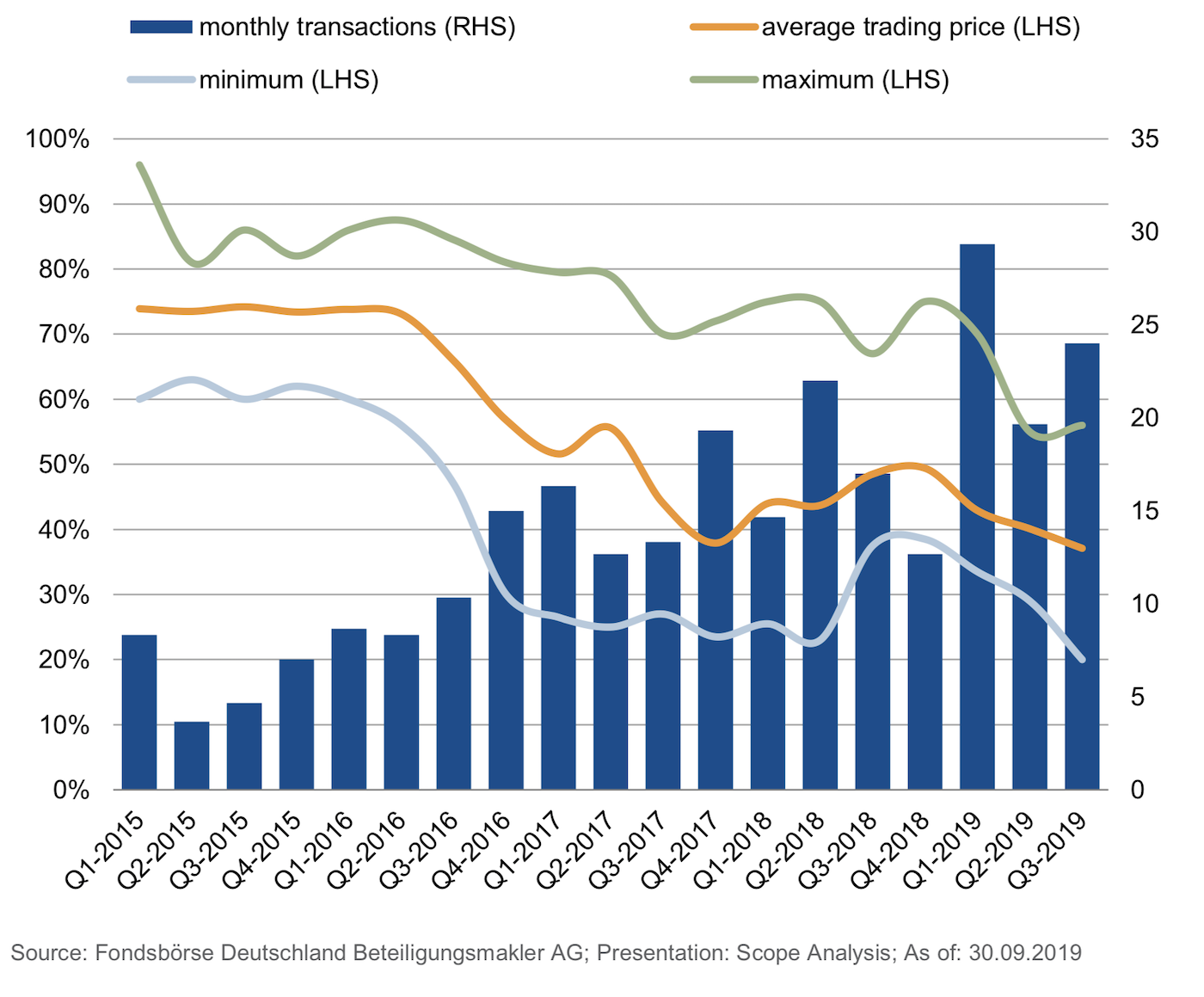

Figure 1 (above) gives an overview of the development of secondary market prices for closed-end A380 funds over the past years. Here is how prices have responded to the recent ups and downs in the A380’s relatively short history – the plane’s inaugural flight was in 2007.

Before Q2 2016

Before Q2 2016, the secondary market was practically “normal”. Trading prices were between 60% and 90% of nominal value. Discounts of up to 20% are the rule on the secondary market for closed-end fund shares – even for funds that perform in line with the prospectus.

Q3 2016 to Q1 2017

In September 2016, Singapore Airlines announced that it was waiving the option to extend the initial aircraft lease. The impact on the secondary market was clear: average prices fell steadily to 50% as buyers began to question the future viability of the A380.

Q1- 2017 to Q2 2017

In the first half of 2017, there was only little trading in the “critical” funds, as there was great reluctance on the part of buyers. The number of monthly transactions fell by 20% compared to the previous quarter. The average price, on the other hand, rose at least in the short term, as only supposedly safer A380 funds with longer lease terms were traded. All in all, this was a brief uptrend, with the average moving back from 50% to 55%.

Q2 2017 to Q4 2017

At the beginning of 2017, the appraiser Ascend lowered its expectations with regard to the market values of second-hand aircraft, as well as the level of leasing rates expected to be attainable in the secondary market. In addition, Singapore Airlines returned the very first A380 to its owner in autumn 2017.

Singapore Airlines had already announced in early summer that it would return a total of four A380s to the lessors by the end of March 2018, making pre-owned A380s available for the first time. The impact on the secondary market for closed-end fund shares was clear: prices fell again, and significantly. On average, prices fell from 55% to just under 40%.

Q4 2017 to Q4 2018

Price leap: In early November 2017, Airbus and Emirates confirmed that they were in advanced negotiations for another A380 order. On this occasion, Airbus CEO Thomas Enders commented positively on the future of the superjumbo: “I am convinced that we will still be building A380 aircraft in ten years’ time.”

The approved part-out concept for the first two A380 funds provided additional stimulus for the secondary market prices. This increased planning security ensured that the average price rose again from just under 40% to 50%.

Q4 2018 to Q3 2019

In February 2019, Emirates shifts a large part of its remaining A380 orders to the A350. As a result of this decision by its most important A380 customer by far, Airbus announces that it will cease production of the model in 2021. The secondary market responded as expected. Prices fell again – on average from 50% to around 37%.

Outlook: aircraft “part-out” creates certainty

Without short- to medium-term visibility for the expiring leasing contracts of the A380 funds, investors can expect a further gradual decline in the trading prices. Further part-out deals could provide relief, as the resulting certainty could stabilise prices.

Recent developments have not fundamentally changed the prospects for investors in the A380 funds. Scope continues to believe that investors will not suffer any losses – see Scope’s report Airbus A380 – Part-Out as Last Option. However, the returns originally projected in the prospectus will not be achieved, but will rather be in the lower single digits.

Interestingly, funds whose A380s are already in a part-out are even trading at slightly higher prices (see Figure 2 below). This is mainly explained by the increased certainty of selling the planes for parts rather than waiting for a new buyer or operating lease. There is a set time horizon for the two funds currently in the part-out phase to sell the last aircraft components. In addition, the latest information suggests that the current part-out process is proceeding according to plan.

According to an investor letter from August 2019, the dismantling of the two aircraft has now been completed. The components which have not yet sold are in storage. Work continues on the sale of the remaining aircraft part. The entire sales process is scheduled to last around two years.

The two fund companies involved have so far generated sales proceeds of around US$19 million each. As a result, the bank loans were fully repaid in July 2019. The two funds DS 129 and DS 130 are thus debt-free with respect to the financing banks. A payout of 5% to the investors was to take place before the end of 2019. The next subsequent payout is planned for spring 2020.

The buyers on the secondary market seem to have confidence in the part-out concept, leading to correspondingly higher purchase prices than for the funds in which the aircraft are retired or the initial leasing contract nearing its end.