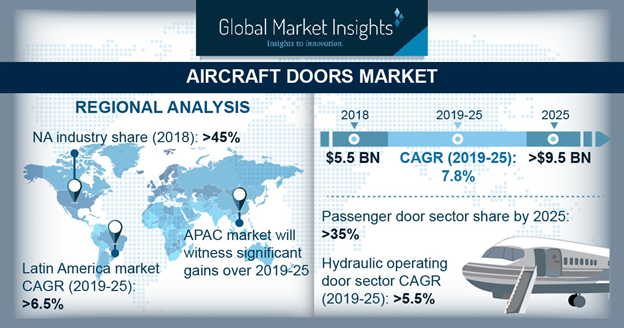

According to a new research report by the market research and strategy consulting firm, Global Market Insights, Inc, the market for aircraft doors is estimated to grow at a CAGR of around 7.5% from 2019 to 2025.

A growth in air carrier fleets, driven by increasing air passenger traffic, will augment growth in the aircraft doors market over the timeframe. As per International Air Transport Association (IATA) data from 2017, passenger traffic rose to four billion, an increase of over 8% compared with 2016. Air carrier manufacturers such as Boeing, Bombardier and Airbus are upgrading their manufacturing facilities to meet increasing demand and reduce production backlogs. For instance, in November 2018, Airbus’s jetliners production backlog stood at more than 7,300.

Aircraft manufacturers are focusing on reducing the overall airplane weight to enhance fuel efficiency and profitability. Government entities are taking initiatives to adopt innovative materials for structures. For example, in 2014, the European Union funded research to incorporate carbon nanotubes for producing lightweight and cost-effective structural parts, including landing gear doors. The rising importance of weight reduction solutions for aircraft will drive the aircraft doors market size over the forecast timeframe.

Organizations including the International Civil Aviation Authority (ICAO), Federal Aviation Administration (FAA), and United States Environmental Protection Agency (EPA) govern the adaption of structures in aviation industry to check the carbon emissions of airlines. In March 2017, ICAO adopted CO2 emission standards for reducing greenhouse gas emissions. Further, FAA enforces an advisory circular 25.783-1A, stating the fuselage doors requirements to ensure passenger safety.

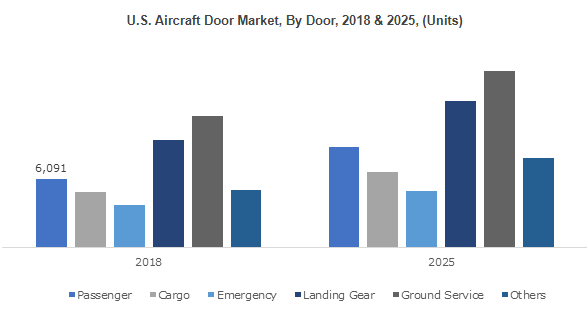

In 2018, commercial aircraft accounted for over 45% of the aircraft doors market, owing to a continuous increase in airplane deliveries. According to CAPA, in 2017, commercial airlines deliveries rose to over 31,000, with an increase of around 4% as compared to 2016. Moreover, rising disposable income in conjunction with annual spending in emerging nations is scaling up the aircraft deliveries, thereby enhancing market share.

Cargo doors are expected to witness significant gains over the forecast period, driven by the rise in cargo transport. According to IATA, in 2018, air cargo transportation exceeded 60 million tonnes, with an increase of around 4.5% as compared to 2017. Air cargo transportation holds significant share and accounts for over 35% global trade by volume. Airlines such as Cathway Pacific are increasing their load-bearing capacity to support the cargo industry. Moreover,the installation of separate cargo-specific doors in areas such as the bottom of the upswept aft portion on the underside of the fuselage to ease loading and unloading will support growth in the aircraft doors market.

The hydraulic operating mechanisms market will register a CAGR of around 5.5% CAGR by 2025, owing to growing adoption of automatic actuation mechanisms for easy operation. The system allows superior accuracy and requires less maintenance. Ongoing innovations offering high power-to-weight ratios and self-contained systems will create significant potential in the market size for hydraulic aircraft doors. However, rising concerns for system reliability in adverse weather conditions will limit their growth in the aircraft doors marketplace.

The OEMs hold a significant market share as they install doors during line-fit manufacturing. Component manufacturers are adopting innovative solutions to the enhance time and cost efficiency of supply chain. Moreover, industry players are integrating into the supply chain to reduce complexity and ease material availability at each stage. The aftermarket segment will project a robust growth owing to the requirements for aircraft system replacement and continuous maintenance to ensure correct operation and passenger safety.

North America dominates the aircraft doors market size owing to the presence of major airplane manufacturers such as Bombardier Aerospace, Boeing and Lockheed Martin. Moreover, the presence of large number of airports handling large traffic will positively influence the product demand. Asia Pacific will exhibit a robust growth with improving economic conditions and the emergence of new low-cost carriers.

Latin America’s aircraft doors market share will witness a CAGR of over 6.5% during the study timeframe, again due to rising aircraft fleets. Airlines are continuously expanding their commercial and regional jet fleets to accommodate a larger number of passengers. For example, in July 2018, Embraer received an order for more than 20 regional jets from Azul Linhas Aereas Brasileiras. Middle East & Africa is at nascent stage and is bound to witness significant growth owing to a surge in the tourism industry.

Major market participants in the aircraft doors industry include Latecoere, Saab AB, Mitsubishi Heavy Industries, Elbit Systems, and Aernnova Aerospace S.A. Manufacturers are strengthening their R&D capabilities for developing innovative solutions that incorporate advanced mechanics and electrical actuation. For instance, in 2017, Latecoere introduced the NexGED door under the ASGARD project, which substituted mechanical parts with electric activation. Moreover, industry players are undergoing strategic collaboration with the airplane manufacturers to provide customized solutions.