The market for in-flight connectivity (IFC) in business aviation is on the cusp of a major transformation, with a new generation of tech-savvy passengers redefining what a premium connectivity experience should look like. For those who’ve grown up always connected, seamless video calls, online gaming, and even live trading are becoming must-haves, at all times.

The low-bandwidth, high-latency systems of yesteryear struggle to support these applications, and low-earth orbit (LEO) satellite networks like Starlink and OneWeb are poised to step into the void and massively disrupt the status quo, powering a growing share of the nearly 30,000 IFC terminals Valour Consultancy expects to see flying by 2033.

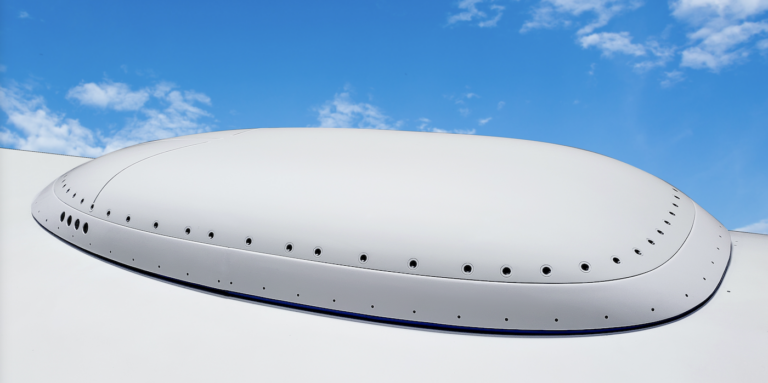

The company’s fourth edition of its flagship report, ‘The Market for IFC in Business Aviation 2025‘, delivers the most forward-looking analysis of connectivity adoption in this segment to date, capturing this evolution in depth. It reveals that while LEO-only solutions are gaining traction – particularly on smaller jets – larger airframes with more complex mission profiles will continue to require multiple, redundant paths off the aircraft.

A non-geostationary orbit (NGSO) component is now crucial in any IFC offering. LEO-only setups will do well on smaller jets that have previously had to make do with legacy air-to-ground (ATG) and/or L-band connectivity, but there is a clear opportunity for multi-orbit or multi-technology solutions in other segments, as we’ve already seen in commercial aviation.

For operators such as Head of State operators, Primary, Alternate, Contingency and Emergency (PACE) configurations will become increasingly commonplace, with LEO forming just part of the puzzle, alongside other technologies.

While Starlink enjoys first-mover advantage in the NGSO space, it is clear that business aviation remains a specialised market that demands comprehensive technical support and a high-level of customer service – areas where experienced value-added resellers (VARs) have the edge. This will play into the hands of Gogo, which is offering its OneWeb-powered Galileo service.

The white-glove approach is still essential in this market. But Starlink’s more hands-off, vertically-integrated approach, combined with its simple pricing model and ease of installation is clearly resonating, as we’ve seen from a string of airline wins recently. It’s clear that a variety of solutions and vendors will have a role to play, particularly given today’s geopolitical climate.

Spanning over 200 pages of qualitative analysis, ‘The Market for IFC in Business Aviation 2025‘, offers in-depth commentary on the evolving competitive landscape, emerging technologies, and key growth drivers. A brochure containing a table of contents can be accessed here.