The global commercial aircraft market continues to be on a roll in one of its longest aviation super-cycles, driven by strong tailwinds with strong demand drivers for air traffic growth, supply side factors in form of introduction of re-engined aircrafts offering enhanced operating economics, and multiple, favourable macroeconomic factors boosting air travel across most key parts of the world. This situation has created a huge order backlog for the aircraft industry, which is likely to translate into significant top line growth potential for the entire aviation industry value chain over the next decade.

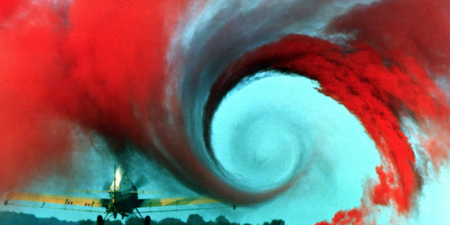

Next generation aviation turbofan engines, featuring a high bypass ratio and extensive usage of technological innovations, have just entered service over the recent years. The industry has just seen the entry into service of three new aircraft programs in 2018, led by Boeing’s 737 MAX 9, Airbus’s A321LR and Embraer’s E190-E2. However, the spotlight in 2019 is going to be on the Boeing’s 777X program, which is scheduled to undertake its maiden flight in 2019 powered by the GE 9X, the largest commercial turbofan engine ever.

2018 turned out to be another good year for commercial aviation, with both Boeing and Airbus producing aircraft at frenetic rates to airline customers. Boeing and Airbus delivered a record total of 1,606 aircraft collectively in 2018, with the US giant’s tally of 806 staying marginally ahead of Airbus’s 800.

The order intake for new aircraft across OEMs remained strong in 2018, with the combined order intake across Airbus and Boeing pegged at 1,600+ aircraft for 2018, indicating that the current aviation boom cycle is holding strong, with sustained demand from airlines for new aircraft. Airline profitability continues to be strong despite the volatility in global crude oil prices and the slowing down of the world economic growth from the ongoing trade wars, with the forecasts for 2019 indicating that it is likely to be the tenth consecutive year of strong profitability for airlines, translating into another windfall year for MRO providers and aircraft OEMs.

The long-standing rivalry between Boeing and Airbus has gone to the next level, with Airbus having gobbled up the C-Series program from Bombardier, which has been rechristened it as the highly versatile A220. Boeing is also in the final stages of forming a business combination agreement with Embraer’s commercial aircraft business, which really lacks a modern, 21st century design aircraft, like the A220.

However, Boeing has a much more serious set of problems to deal with than its more comfortably placed arch-rival, with the grounding of the global 737 MAX fleet over MCAS issues following two fatal aircraft crashes. This situation poses a serious threat to Boeing’s top line and financials going forward, with reduced production rates and the possibility of potential legal damages over lawsuits, the emergence of quality issues over the deliveries of the recent KC-46A tanker deliveries to the USAF, and lastly the Trump initiated US-China trade war is likely to sway the world’s largest and fastest-growing aviation market further towards Airbus, which already has a substantial industrial presence in the country. Boeing has a big and difficult task at hand in addressing these critical issues to the satisfaction of the stakeholders involved, given that its 737 order backlog is worth almost seven years of production and half a trillion dollars in value.

The technology landscape across industry is also evolving radically with the development of hybrid-electric propulsion technologies for commercial aircrafts. This technology is aimed at reducing CO2 emission levels drastically while scaling down operating costs substantially, and is likely to become a functional reality by the middle of the next decade, with multiple industry teams across the globe focused on pursuing R&D on the electric propulsion technology, which necessitates radical improvements in battery technologies.

The evolution of Urban Aerial Mobility (UAM) is likely to provide a new battle front for the traditional Airbus-Boeing rivalry to unfold going forward, with both aviation giants looking to capture a share of the highly lucrative growth pie. The developments on the UAM front are also likely to provide a significant push to the development and commercialisation of a range of game-changing aviation technologies. The industry, however, is also gearing up for the age of disruptive technologies, led by digitalisation, additive manufacturing, unmanned and optionally manned operating capabilities and artificial intelligence, making the most of this current phase of demand upswing.