IBA views IAG’s announcement that it will purchase (pending shareholder approval) 50 737 MAX aircraft from Boeing as a win for the OEM, given the negative news cycle it has encountered in recent weeks and months as we have moved through the conference cycle and earnings season.

This positive news follows Shanghai-based China Eastern’s and Guangzhou-based China Southern’s indications that the B737 MAX will not form part of their near-term fleet plans, despite the aircraft reportedly being close to gaining approval for a return to service from Chinese regulators. The addition of a marquee customer such as IAG for the programme is a major win for the OEM, given that other big names such as KLM and Qantas have announced Airbus as their preferred partner for their respective narrowbody fleet renewal strategies, via the A220 and A320neo families.

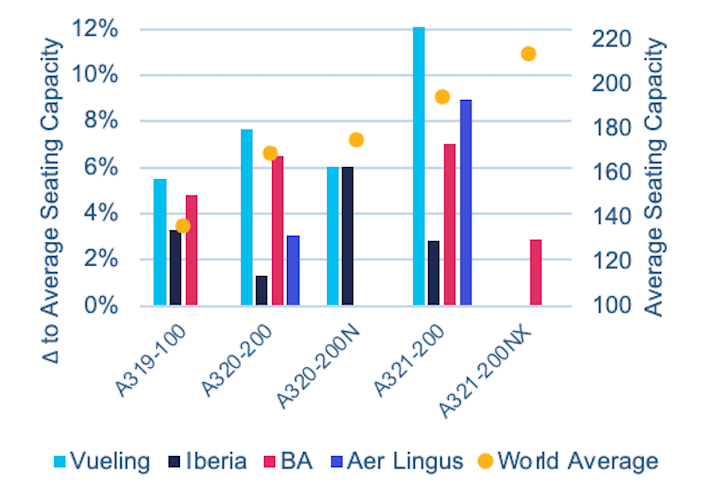

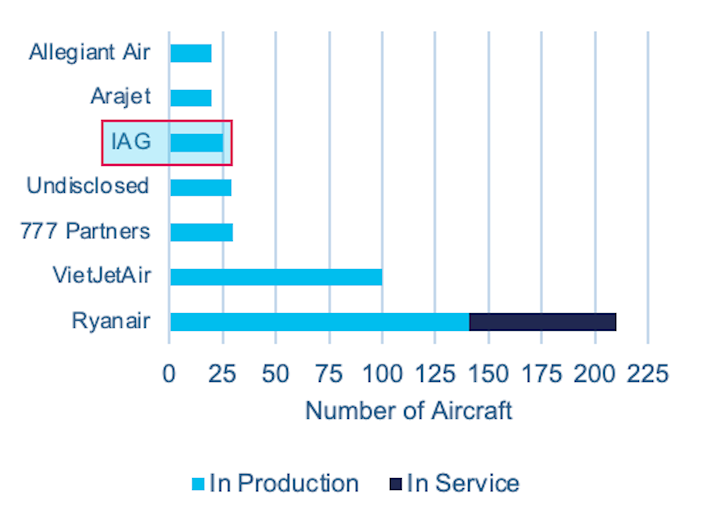

One key question arising from the announcement is the destination within IAG for these MAX aircraft, particularly the B737 MAX 200. The aircraft has so far been associated with Ryanair and other low-cost carriers, with IAG proving an outlier on Boeing’s list of customers, as indicated in the intelligence from IBA Insight (see graphs below). IAG does however feature above-average seating density across its fleet of Airbus narrowbodies (see below), with typically 5-10% more seats compared to the world average LOPA (layout of passenger accommodation).

While IAG’s LCC brand Vueling may appear the obvious choice given the existing customer list, IBA’s data indicates that IAG’s A321-200s in service with all four of its airline brands are in many cases 15-20 years old and are potential candidates for retirement in the coming years. One further option could be British Airways’ EuroFlyer subsidiary at London Gatwick, where the 197-seat 737 MAX 200 would allow the carrier to lower unit costs in order to compete with Gatwick’s primarily LCC incumbents. IBA will be watching this space closely.