The equity argument

One prominent topic that was apparent from reviewing literature for the purpose of this research was that of airlines applying ‘equity’ in their pricing and baggage policies. With statistics suggesting a continuous trend in weight increases within many western countries this is likely to be an attitude and an argument that airlines will be subjected to increasingly in future years of operations.

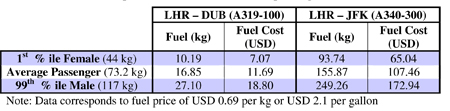

In order to model and assess the validity of the ‘equity’ argument, anthropometric data has been used to model the difference in fuel consumption attributable to a typically light and heavy UK passenger on two different flights. The fuel requirements (as shown in Table 8.6) were based upon an average passenger weight equal to that of the known average adult weight from 1998 with subsequent calculations based upon known body weight values of 1st percentile UK females and 99th percentile UK males.

Fuel requirements of any aircraft are directly related to its load and therefore unsurprisingly the above results show that an above-average passenger (in terms of weight) will account for a higher amount of fuel consumption than a below-average passenger. The natural variation in a characteristic such as body weight means that inevitably airlines average out the total cost of fuel across all passengers and unless an airline chooses to base a revenue strategy related to weight this is unlikely to change.

Excess charges

Arguably, the above analysis is somewhat understood by the air-travelling public and there exists little visible dissatisfaction that the natural variation between individuals’ body weights accounts for different fuel requirements on a per-passenger basis. The equity argument is most pronounced in situations whereby passengers are subject to additional weight-based charges in relation to an airline’s baggage allowance policy. Excess baggage policies appear to vary between both the type of airline and the route being served. For example British Airways and Virgin Atlantic both operate a one-off fixed fee for each piece of luggage that exceeds the prescribed limitations irrespective of the amount by which it is exceeded. However, weight-based charges appear much more common within the low-cost segment, examples of which include EasyJet’s policy of charging GB£6.00 per kg of excess weight and a respective charge of GB£5.50 for Ryanair passengers. Perhaps understandably, ‘per-kilo charge’ policies represent an important source of additional revenue for low-cost carriers.

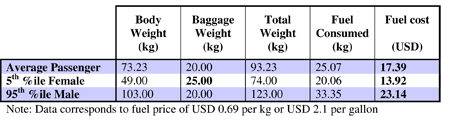

Table 8.7 below has been compiled to show the difference in fuel attributable to passengers on an A319-100 over a sector length of 500nm. The modelling of this sector assumes an average passenger weight based upon 1998 UK adult weight data combined with an average of 20kg of baggage. To realistically model the equity argument 95th percentile male and 5th percentile female weights have been used with the latter carrying 5kg of extra baggage.

If it is assumed that an airline flying such a sector operated a maximum baggage allowance per passenger of 20kg, the results show that for a typically light UK adult female carrying 5kg of excess baggage, the fuel consumption attributable to that passenger is still approximately 40% less than that of a typically heavy male carrying the prescribed allowable baggage. In the case of EasyJet’s policy this 5kg excess baggage would correspond to an additional charge of GB£30 or US$61. On a flight of this length and aircraft type the actual fuel cost of transporting this additional 5kg amounts to less than US$1. The remaining US$60 of the excess charge alone would therefore entirely cover the fuel cost of three fellow passengers of average weight carrying 20kg of baggage.

Regardless of an airline’s ability, willingness or awareness to assess the potential economic impact of increases in passenger weight over time, the above analysis has demonstrated that population weight gain is an issue that undoubtedly has imposed a significant economic impact upon air services, whether at the eventual cost of the consumer or the airlines themselves. Whilst in conducting this analysis only limited data relating to just a few specific aircraft were made available, the outcomes have allowed this conclusion and an assessment of the magnitude of this economic impact to be made to a high degree of certainty. To completely evaluate the precise extents of this impact specific to a particular airline would require much more intensive analysis to be carried out across all aircraft types operated combined with specific operating data to account for the assumptions that were made in the data provided by Airbus. Nevertheless it has been shown that known historic changes and highly probable future rises in the weight of passengers is a management issue that from an economical viewpoint should not be ignored by airlines.

The impact of accommodating larger passengers

As discussed earlier, the UK CAA’s ‘Anthropometric Study to Update Minimum Aircraft Seating Requirements’, carried out on behalf of the JAA, found that many of the passenger seats on today’s European aircraft are often inadequately sized to seat a significant proportion of European individuals comfortably. An important finding of the study related to seat width and the difficulty that larger European passengers face fitting between armrests as well as getting in and out of seats themselves. Directly related to the trend in western passengers getting physically bigger, the report recommended that any subsequent minimum seating specifications should include a minimum seat width of 19.6in or 497mm. For the purpose of this research the CAA were contacted in relation to the report findings, through which correspondence suggested that at no point had an economic impact assessment of the recommended minimum seating criteria been conducted. Therefore I will aim to assess how and to what extent the implementation of this minimum seat width may affect an airline and the economics of its operations in accommodating the growing size of western passengers.

In the US all major national and regional carriers are required to submit detailed financial statements to the US DOT (Department of Transport), including aircraft-specific operating expenses, published under the title of ‘Form 41’ data. Whilst there exists no European equivalent of such financial reporting, use of the American data allows an assessment to be made as to how a 19.6in minimum seat width, or indeed any conceptual increase in seat sizes, may affect the economics of airlines and particular aircraft types. Although undoubtedly there are differences between the respective markets of Europe and the US, there exist many similar operational aspects between airlines operating within both regions. For example fuel costs, aircraft configurations and crew costs are unlikely to be significantly different for US carriers than their European counterparts. This assessment will therefore combine the recommended minimum 19.6in seat width formed in the CAA/JAA study with 2005 US Operators’ statistics to form a hypothetical understanding of how European airlines operating similar aircraft would be affected by the introduction of minimum seating criteria, and the magnitude of this impact.

The following analysis has incorporated data from websites including seatguru.com, used to obtain information relating to current aircraft configurations and seat dimensions specific to particular airlines and aircraft types. It should be noted that there exists very limited information in relation to the size of airlines’ and aircraft’s current aisle widths, and that furthermore many airlines exhibit slightly different configurations of seating, even between identical aircraft types. As such the following analysis is based upon the calculated absolute minimum number of seats that would be lost from current configurations following the adjustment of existing seat dimensions, under the assumption that in each example the aircraft’s aisle width remains unchanged.

For example, an aircraft currently configured with 100 seats each with a width of 17in corresponds to a total accumulated cabin seat width of 1,700in. This total width of existing seats would accommodate an equivalent of 86.7 new seats exhibiting the revised 19.6in width (calculated by dividing the total width of all existing seating by the new 19.6in minimum). Subsequently, under this example, the aircraft’s capacity after the adjustment of seat widths would hypothetically decrease by a minimum of 14 seats. It should be implicitly highlighted that due to limitations in the availability of corresponding data, employing this methodology for the following analysis does not account for potential adjustability of cabin aisle widths. Existing aircraft types, aircraft configurations and airline seat designs may, in some cases, allow an airline to increase the width of its seating by reducing the current width of cabin aisles.

For example in a narrow-body short-haul aircraft such as an Airbus A319, typically configured with three seats either side of the cabin’s single aisle, an increase of 1.5in in each seat’s width could be accommodated by a 9in reduction in the width of the cabin’s aisle. However, the feasibility of such an adjustment would require considerable further research assessing elements such as the use of airline service trolleys and existing regulations with particular regards to any potential impact that may be imposed upon the ability of passengers to evacuate an aircraft in a safe and timely manner in the event of an emergency. Therefore for the purpose of this research the following analysis is based upon the adjustment of aircraft’s existing total seat widths and the calculated accommodation of the wider seats that would fit in this same space. This methodology has been used in conjunction with the form 41 data to review how the operating economics of aircraft change under seat width revisions. This has been carried out for four aircraft types representative of the typical range in size of jet-powered aircraft in today’s market.

Northwest Airlines Airbus A319

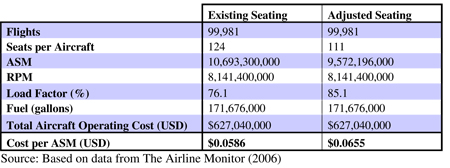

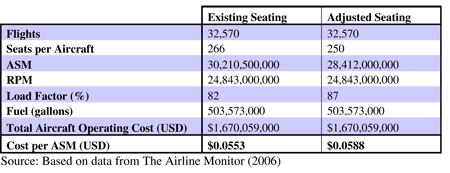

Northwest Airlines’ fleet of 71 A319 aircraft are typically configured with 16 first class seats and 108 coach class seats with seat widths of 21in and 17.2in, respectively. Applying this configuration to a minimum seat width of 19.6in would effectively result in the removal of 13 coach class seats and therefore a reduction in aircraft capacity of 10.5%. The effect of which is shown in Table 9.1

The above analysis assumes that the number of flights, revenue miles and passenger numbers will remain the same. In this example, even with the removal of 13 coach seats, the airline would still be capable of transporting the same number of passengers and thus expenses such as fuel, maintenance, rent and depreciation have not been adjusted. Although in making these assumptions Northwest would not be subject to any change in the total operating cost of this aircraft, there are two important impacts to consider. Fundamentally the airline will have 13 fewer coach class seats to sell on each of its flight, and will thus lose the potential revenue that these seats may produce. Furthermore, as shown in Table 9.1, the total seat reduction will lead to an 11.7 % increase in unit costs (cost per available seat mile). Therefore in order to maintain the same profitability, although not given, the airline would have to produce an equivalent increase in its unit revenues in order to account for the higher cost of transporting each seat.

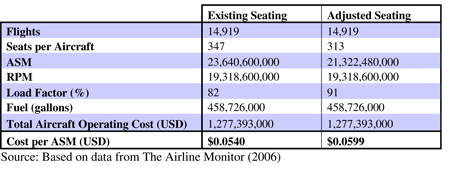

Southwest Airlines Boeing 737-300

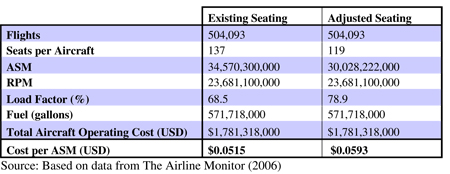

As with most low-cost carriers, Southwest Airlines offers a single-class configuration on its aircraft in order to maximise each flight’s capacity and subsequently achieve lower unit costs. Southwest’s fleet includes 194 Boeing 737-300 aircraft configured with 137 economy seats, each with a width of 17in. This configuration would result in the loss of 18 seats per aircraft following the adjustment of seat widths, representing a loss of over 13% in each flight’s current capacity. The corresponding results analysing this impact are detailed in Table 9.2 below.

Southwest’s current load factor implies that even with 18 fewer seats on each of its 737-300 aircraft, the airline would still be capable of transporting the same number of passengers as in 2005. Under the assumption that this will subsequently cause no change to the total aircraft operating cost, the unit cost (cost per ASM) will rise by more than 15%. This increase is not only significantly higher compared to that of Northwest, but certainly presents a bigger concern to an airline heavily dependant upon low unit costs in order to deliver cheap air travel to the US public.

United Airlines Boeing 777-200

In the reported operating year for 2005 United Airlines operated 52 Boeing 777 aircraft. Although there does exist differences between the seating configurations of these 777s, for the purpose of this analysis it has been assumed that a typical seating layout consists of 114 economy seats, 84 economy plus seats and a further 64 seats in business and first class. Although the seating within the business and first class cabin sections exhibit a width greater than the recommended minimum of 19.6in, both the economy and economy plus seats only offer a width of 18in. The introduction of the minimum seat width would therefore result in the loss of a total of 16 seats, representing a loss in total passenger capacity of 6%. The impact of this is detailed in Table 9.3 below.

Again the results of this analysis show that in this example the introduction of a 19.6in seat width would not compromise the ability of United Airlines to carry the same number of people over the same flights. Subsequently there is an evidential rise in the theoretical load factor under the new seating requirements whilst the operating cost of the aircraft would remain unchanged. As a result of this seat adjustment the unit cost (cost per ASM) under these conditions would increase by 6.3%, representing a comparatively less significant effect than that demonstrated by both the Airbus A319 and Boeing 737.

United Airlines Boeing 747-400

Seating a total of 347 passengers, United’s fleet of 31 Boeing 747-400 aircraft are all configured in a four-class arrangement. The introduction of a mandatory 19.6in seat width would only affect the 260 seats found in economy and economy plus sections of the aircraft that offer an existing seat width of 17in. Subsequently a total of 34 seats would be lost from the 747’s current configuration, representing a total loss in capacity of 9.8%, the impact of which is shown below in Table 9.4.

As with each of the aircraft examples discussed thus far, the results show that due to United’s recorded load factor on this aircraft type, the loss of 34 seats would still enable the airline to carry the same number of passengers across the services compiled in these reporting statistics. However, the near 10% loss in passenger capacity would result in a 10.9% increase in unit costs, an increase greater than that of the 777-200 considered but less than the smaller aircraft types.

Load factor variation

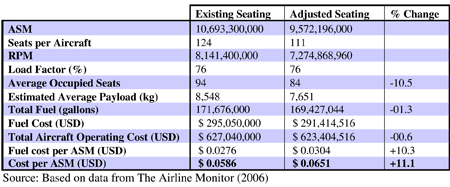

Although the above analysis demonstrates that each of the airlines considered would still effectively be capable of carrying the same number of passengers over the same flights with the introduction of a 19.6in minimum seat width, it is important to understand that this is representative of the airlines’ reported annual average load factors. However, nearly all air services are subject to peak and off-peak travel periods combined with differing levels of seasonality, ultimately leading to differences in load factors between individual flights. Therefore whilst it may appear that an airline can transport the same number of passengers, this is highly unlikely to be the case under circumstances in which load factors for certain flights are significantly higher than that of an airline’s yearly average. The following analysis therefore assesses the impact of the recommended minimum seat width assuming that an airline’s load factor will remain unchanged subsequent to adjustments of its aircraft seating. This has been done using reported data for Northwest Airlines’ Airbus A319 aircraft in combination with aircraft performance data as provided by Airbus as shown in Table 9.5 below.

Unlike in the preceding analysis, in assuming that the airline’s load factor will remain the same following the adjustment of seating, the total number of passengers carried is forecast to decrease and a subsequent adjustment in fuel consumption has been made. This has been achieved by calculating the difference in fuel requirements, over the airline’s average sector length of 863nm, subject to 10 fewer passengers (as shown in average occupied seats above). Using the A319 aircraft performance data as provided by Airbus, the removal of 10 passengers would result in a 1.3% decrease of fuel consumption, based upon Northwest Airlines’ average passenger and baggage weight of 90.7kg as calculated from IATA WATS (2005).

Following the introduction of 19.6in seat widths, the results show that Northwest would lose an average of 10 passengers per flight. It is likely that, with the exception of fuel, all operating expenses including crew costs, maintenance, depreciation and rent are likely to remain unchanged by the anticipated decline in passenger numbers. Subsequently the 1.3% decrease in fuel consumption results in the reduction of total aircraft operating expenses by 0.6%. However, the results show that the decrease in passenger numbers is of a far greater magnitude and subsequently it can be seen that there is an 11.1% increase in unit costs. Using these values it has been calculated that the average operating cost attributable to each passenger under a load factor of 76% increases from US$66.55 under the current aircraft configuration to US$73.91 per passenger under the implementation of 19.6in-wide seats.

It can be seen that by comparing these results with those found above that the increases in unit cost as a direct result of new seating requirements are not significantly different between a scenario in which the load factor remains unchanged and a scenario in which passenger numbers remain unchanged. Ultimately if, after seating adjustments are made, an airline’s load factor remains the same as prior to when the changes were made, then any subsequent reduction in fuel requirements represents only a fractional saving in the aircraft’s total operating costs. It can therefore be seen that any reduction in operating costs as a result of lower fuel requirements are far outweighed by the impact in the reduction of the aircraft’s capacity and therefore a similar increase in cost per ASM under both situations is present. It can therefore be assumed that the rise in unit costs calculated for the Boeing 737-300, 777-200 and 747-400 are representative of the magnitude of this increase even if, after seating adjustments are made, the respective operators maintain a similar load factor and thus carry fewer passengers in total.

Estimating the impact of seat specifications in Europe

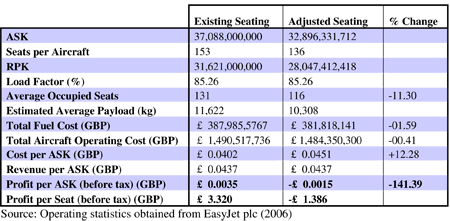

Carrying out a hypothetical impact analysis of a minimum seat width for European carriers is ultimately limited as there is no corresponding requirement for the reporting of operating and financial data specific to individual aircraft types. In conducting this research no European airlines were found to have reported operating results on an individual aircraft type basis. However, in an annual report, EasyJet published detailed operating and performance statistics, and given that this airline’s fleet consists of just two similarly sized aircraft types, 75% of which are Airbus A319s, an impact analysis has been carried out to form an approximation as to how one of Europe’s leading low-cost carriers would be affected by new seating standards.

Whilst this analysis will be distorted by EasyJet’s operation of two aircraft types it offers an estimation of the magnitude of the impact of a recommended minimum seat width. Furthermore given that the above results have shown that low-cost carriers are likely to be amongst the airlines most heavily impacted by introducing larger seats, estimations based upon EasyJet are likely to represent a somewhat worst-case scenario for European carriers.

Table 9.6 has been compiled based upon data from EasyJet plc’s 2006 annual report and shows that the airline offers an average of 153 seats per aircraft. With existing seats on both aircraft offering a width of 17.5in, the introduction of a 19.6in minimum would result in the average loss of 17 seats per aircraft and therefore a loss in each flight’s capacity of 11%. Under the assumption that EasyJet will maintain its recorded load factor of 85% following the seating change, a subsequent fuel adjustment to aircraft operating expenses has been made. This has been achieved using Airbus A319 aircraft performance data and assessing the change in fuel requirements, over the airline’s average sector length of approximately 1,000km, from the effective removal of 15 passengers per flight. These calculations are based upon EasyJet’s reported average passenger and baggage weight of 88.9kg (IATA WATS 2005).

The results show that in maintaining the same load factor, the calculated loss of 15 passengers would result in a 1.6% reduction in fuel costs. It is assumed that all other operating expenses such as crew, rent and depreciation will remain unchanged, and therefore a reduction in total aircraft operating expenses of 0.4% has been calculated. The relative loss in capacity is far greater than the decrease in operating costs and subsequently it can be seen that unit costs increase by 12.3%. Combining this data with the reported financial statistics of EasyJet, the analysis shows that if EasyJet’s revenue per seat also remained unchanged after this hypothetical seat change, the airline would be operating at a loss with a calculated loss per seat of GB£1.39. In order for the airline to maintain its profit per seat of GB£3.32, its revenue per seat would require increasing by 11.3%. In monetary terms this represents an increase from the current average revenue per seat of GB£41.66 to GB£46.36. However, given that the airline is losing seats on its aircraft, even if profit on a per-seat basis is maintained, the airline’s total profit will decrease. The results suggest that after the implementation of a 19.6in seat width, EasyJet would have to increase its revenue per seat to GB£46.79 in order to match its 2006 pre-tax profit of GB£129.2 million, an increase of the airline’s current revenue per seat of 12.3%.

Analysis findings

The impact of minimum seating standards clearly differs between both aircraft and airline type. Analysis has shown that, of the aircraft types considered, the magnitude of the impact of increasing seat widths is related to the density and size of current seating and cabin configurations. For example, low-cost carriers, such as Southwest Airlines and EasyJet, offering a high-density all-economy cabin configuration, are likely to be subject to more significant increases in unit costs and decreases in capacity, as essentially every existing seat on their aircraft would require changing. This is not so for larger aircraft with multiple class sections, which typically exhibit a number of seats already offering a seat width greater than that of the recommended 19.6in minimum assessed. Therefore for carriers offering premium classes, the reduction in aircraft capacity and subsequent rise in unit costs is unlikely to be as great as an all-economy configured aircraft operator. It may therefore be concluded that the impact of minimum seating requirements is a function of the size of an aircraft’s existing seats and the proportion of seats on each aircraft type that would not meet new seating minima.

Ultimately the removal of any number of seats from an aircraft and thus decrease in capacity represents a negative economic impact upon an airline. Even if it appears that the loss in aircraft capacity to meet new seating requirements would still enable an airline to transport the same number of people across the same services over a year of operations, it is fundamental to understand that this is unlikely given that analysis using an annual load factor value ignores the natural load variation that exists between individual flights. If it is assumed that an airline’s load factor is unlikely to change subsequent to such seat changes, it has clearly been proven that the combined loss in aircraft capacity, anticipated decrease in total passengers carried and increases in unit costs has the ability of completely removing an airline’s profitability. The relationship between yield and unit cost is fundamental, and an increase in the latter requires a corresponding increase in the former in order for any airline to operate in an economically sustainable manner. Any rise in unit costs therefore is most likely to be passed on to air travellers themselves.

The airline industry has proven historically to be a delicate business environment, exhibiting marginal results and a strong susceptibility to economic shocks. The hypothetical analysis carried out above has clearly demonstrated how a small adjustment in seat widths may potentially impact and eradicate an airline’s entire profitability, although, it should again be highlighted that some aircraft types may be able to accommodate larger seats through the reduction of aisle widths. For the purpose of this analysis this was assumed not to be the case due to lack of available data and the likely implications this may impose upon the ability of passengers to easily use the aisles, especially in the event of an emergency, and secondary implications such as the potential effect on cabin service trolleys.

Given the fragility of the airline industry it is clear that if wider seats are required for the transportation of increasingly larger passengers, it is essential that this be implemented across all airlines operating in the same market place. The increases in ticket prices that would be necessitated following the introduction of wider seats is likely to deter an airline from changing its seating voluntarily. Furthermore, studies have suggested that the travelling public are not willing to pay more for extra leg room and therefore it should be argued that the same people are unlikely to be willing to pay more for wider seats. If, for the safety and comfort of western passengers, wider aircraft seats are required, it must be ensured that the government and implementation of this process is uniformly applied to all operators within the same market.

Conclusions

There exists a clear requirement for the regulation of aircraft seating and related airline policies. Despite past research showing that existing seating on European airlines are insufficient for a significant proportion of the region’s population, no such regulation appears to have been discussed further nor planned for implementation. Lack of such regulation both in Europe and the US has arguably led to the situation in which some carriers clearly set out policies, such as the requirement for passengers to purchase a second seat, whilst the majority of carriers have no such policy in place. This represents a somewhat confusing situation for the travelling public, particularly for those travellers who may be impacted by such policies. If nothing else, this situation is further amplified by the lack of consistency and the significant differences exhibited between the policies set out by airlines choosing to directly respond to the issues of larger passengers and seating.

A particularly significant finding of this research was the apparent ‘lose-lose’ situation that several airlines have found themselves in following the implementation of policies and guidelines relating to the carriage of larger passengers. Perhaps best exemplified by US carrier Southwest Airlines, a ‘do nothing’ approach can visibly lead to an airline being subject to a high frequency of complaints from disgruntled passengers who have been directly affected by the carriage of physically larger passengers. Conversely the establishment of clear policies, and in particular the introduction of differential pricing, has quite visibly resulted in public outrage, negative media attention and the dissatisfaction of passengers forced to purchase more than one seat. Public opinion seems somewhat divided and there exists a clear split in attitudes towards whether passengers of size should pay more. Subsequently airlines, particularly in regions of the world where the carriage of larger-passengers is most common, have ultimately found themselves in a helpless situation whereby it would appear impossible to please each and every passenger in relation to this issue.

There is a clear perception within western countries that the establishment and enforcing of size-related policies or differential pricing constitutes discriminatory practices. Whilst both European and American laws prohibit the discrimination against disabled and physically impaired passengers in air travel, there exists few occurrences of obesity ever being considered a disability. Although this has evidently not deterred many individuals from legally pursuing discrimination claims against some airlines, it is a pertinent aspect relating to the carriage of increasingly larger passengers that requires careful clarification. Without the establishment of decisive legislation or regulation governing this issue there is a clear danger airlines will increasingly be subject to claims of discriminatory practices in situations whereby passengers have been refused to travel or forced to pay for additional seating requirements. Furthermore, in the event that obesity is eventually considered a disability, it is possible that airlines may increasingly refuse the carriage of larger passengers altogether based on safety grounds in their avoidance of providing larger passengers with additional seating or upgrades at no extra cost.

Analysis into the impact of increasing seat widths in order to accommodate the larger passengers of today highlighted that the subsequent loss of each aircraft’s capacity is likely to increase airlines’ unit costs and potentially eradicate current profit margins. Other than potential attempts at product differentiation, it is therefore unlikely that airlines will voluntarily increase the size of their seating in the likely outcome that any cost increases will be passed on to the travelling public, a risk that most airlines would be unwilling to take.

The considerable differences exhibited by the policies of airlines, the current ‘inadequate’ size of aircraft seating, the labelling and pursuing of differential pricing constituting discriminatory practices and the potential impact that increasing the dimensions of seats would impose upon airlines all give rise to the requirement for regulations to govern this issue. The very presence of any airline choosing to establish size-related policies provides hard evidence that this is a very real and prominent management issue being addressed by carriers today. Regulation is therefore required in order to ensure that such policies and practices are fair, equal and above all recognised and understood by the travelling public. The consequences of ignoring these issues at the highest of levels have clearly been seen in the US through legal pursuits, media coverage and public outcries. Given that it has been proven that UK and European weight is increasing at a similar rate it is likely that respective occurrences will become increasingly common in this region and indeed other regions throughout the world in which weight trends follow a similar path.